You may have heard a lot of talk about Bitcoin (or BTC) lately, and are asking yourself “What is Bitcoin?”. In this tutorial we talk about Bitcoin, one of the most popular cryptocurrencies.

What is Bitcoin?

Bitcoin (BTC) is a store of value and a peer-to-peer electronic cash system that allows users to send BTC freely without having to rely on a third party. The creation of Bitcoin was by Satoshi Nakamoto in early 2009. In wake of the 2008 financial crisis, Satoshi saw the need for a new kind of money.

The current financial system relies almost exclusively on third parties they trust to process payments. They require middlemen are to mediate disputes, which lead to expensive fees and slow processing. Satoshi hoped to create a decentralized peer-to-peer payment system with no reliance on central authorities.

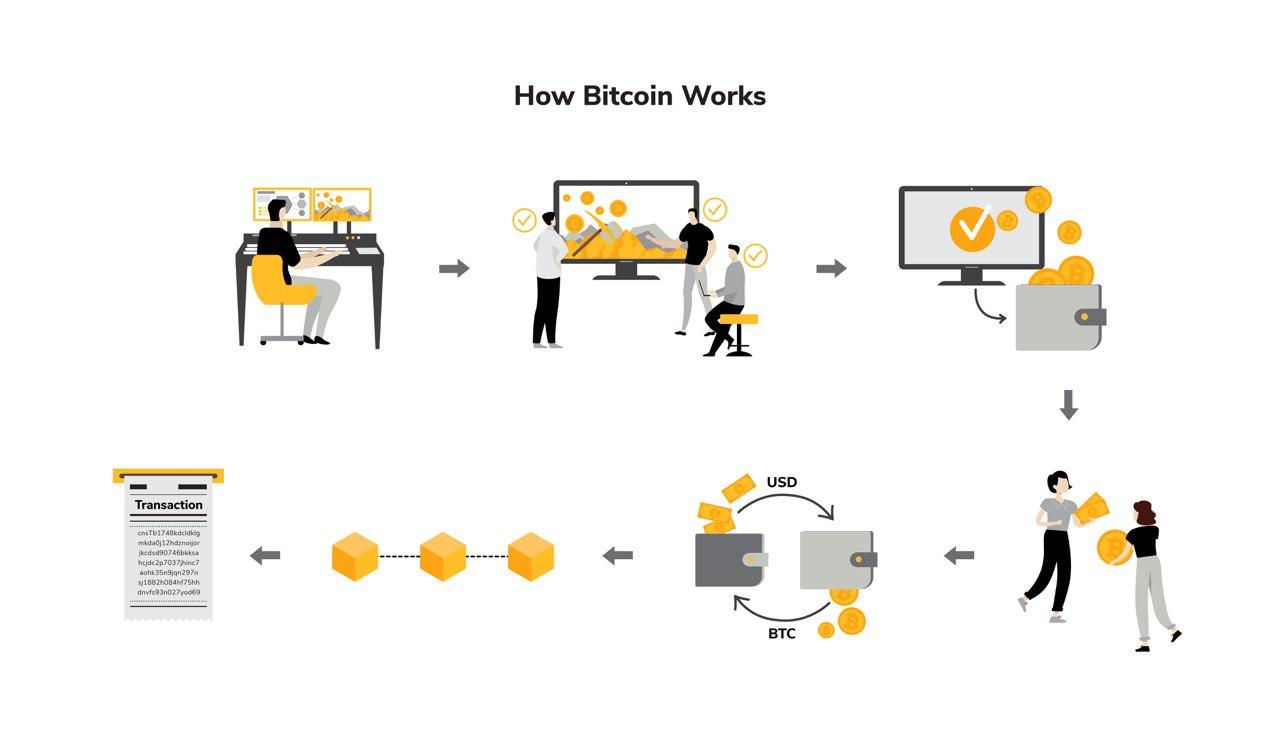

How Bitcoin Works

- In order for Bitcoin to work, it requires a network of miners to continuously mine for BTC. When miners are “mining” for BTC, they are usually solving difficult computational problems. This process requires computers with high computational power and often times will take a lot of energy and electricity.

- Once they solve the problem, the first miner to solve the problem will have to go through a “Proof of Work” (PoW), where other miners in the system have to validate the transaction and ensure the correctness of the problem. Only once the problem receives approval can they record the transaction on the Blockchain.

- Once a successful transaction is written on the Blockchain, the miners will then receive rewards in the form of Bitcoin. These Bitcoins will go directly into the miner’s wallet.

- Those who are looking to invest in Bitcoin will then be on the lookout for miners or network participants that are trading Bitcoins.

- Miners and investors of Bitcoin will then exchange BTC for cash.

- The transaction between the miners and the investors will then be recorded onto the Blockchain.

- These transaction are available for the public to view on the Public Ledger where all transactions are kept transparent and public.

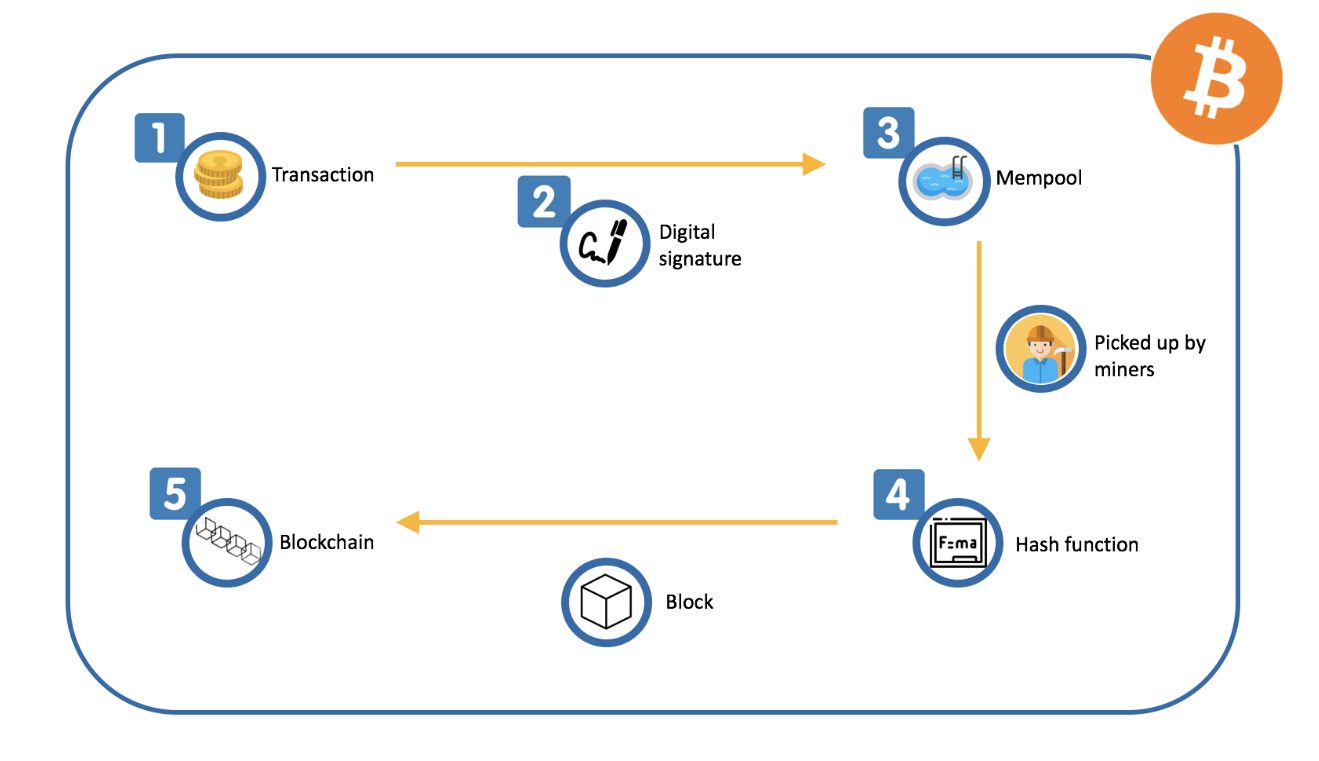

How does Bitcoin Transaction work?

- When we initiate a transaction, it contains information of the sender, the recipient, the transaction amount and a digital signature.

- The user will generate two keys. The digital signature is signed with the sender’s private key and the public key is available to other nodes to verify the signature.

- When a user signs a transaction, it will be sent to a pool of unconfirmed transactions called a mempool (memory pool). Miners pick the transaction and put into the next block.

- Miners validate blocks by solving mathematical problems i.e. hash function. The first miner to solve the problem will receive a block reward paid in Bitcoins. The hash identifies a block and is dependent on the transactions within. Any changes to the transactions will cause the hash to change completely and the rest of the network will reject it. This brings immutability to the history of transactions.

- Miners will broadcast the solved hash (i.e. his ‘proof of work’) to other nodes in the network. When other nodes verify and agree on acceptance, the network reaches a consensus. Nodes express acceptance by working on the next block.

Bitcoin is Not a Physical Currency

Unlike the traditional fiat currency, BTC is not a physical currency. However, the value of Bitcoin equates to the dollar amount on the current market price of BTC. This price typically has a high volatility, but in the long run has grown exponentially over the past 10 years.

Bitcoin is similar to Gold

Similar to gold, Bitcoin has a very finite supply with a total of 21 million BTC that ever be in circulation. At Bitcoin’s current mining rewards rate of 6.25 BTC per Block, Bitcoin’s annual production is equal to Gold.

This is one of the many reasons why people refer to Bitcoin as “Digital Gold”. In addition, the fact that BTC the first cryptocurrency. By and large though, the primary reason for this nickname is due to the scarcity of supply.

Why is Bitcoin Decentralized?

There is no centralised authority in the Bitcoin network. The blockchain ledger distributes across nodes all over the world and is open for anyone to view. The Bitcoin network is a peer-to-peer network where nodes reach consensus collectively. This mitigates the risks of data tampering and data loss.

Dencentralized Mining

The Bitcoin is operated by decentralized authorities having no bank or government control. This allows the individuals and companies to trade BTC anonymously and freely. Those who purchase the Bitcoin are a part of a system that buy/sell and mine BTC. So, in order to maintain the system’s credibility, it requires the “miners” of BTC to continuously mine for new Bitcoins by solving difficult computational problems.

Once a miner solves the problem, the system logs the transaction onto the blockchain where it collects all transactions. The transactions are then available on the public record where anyone can view it. Protection for each transaction is also and made through a unique secure address making the payee anonymous. This process makes it difficult to falsify any payments.

Why is Bitcoin Secure and Immutable?

As a digital currency, bad actors may attempt to double-spend. Bitcoin’s network solves this problem by time stamping transactions.

Each block contains a hash of itself and the hash of the previous block. If a bad actor attempts to tamper with a transaction in the past, the hash of the blocks will change completely. Then other honest nodes will reject the block.

Features:

– Block size: 1MB

– Average block time: 10mins

– Consensus algorithm: Proof-of-Work (SHA-256)

– Supply limit: 21,000,000 BTC

Ways You Can Aquire Bitcoin?

There are a few ways for you to trade Bitcoin. It can be done through an online marketplace cryptocurrencies, an OTC (over the counter) service, or through a Bitcoin ATM. So, once you purchase BTC, you can store them in a digital wallet that functions the same as a physical wallet.